Project portfolio management (PPM) encompasses the optimization of project portfolios to achieve strategic goals. Common approaches include cost-value optimization, resource optimization, schedule optimization, and portfolio balancing. We will show you how it works!

Are you interested in more in-depth insights into project portfolio management?

Our article "Project Portfolio Management - An Introduction For Practitioners With Little Time On Their Hands" provides comprehensive details and insights that will broaden your understanding.

The Various Approaches to Project Portfolio Optimization

One of the most frequent sentence clusters in this blog goes something like this: Project Portfolio Management (PPM) involves the centralized management of one or more project portfolios to achieve strategic business objectives. Project Portfolio Management is commonly a Project Management Office (PMO) task.

Ok, so far so good. But let us rephrase that a bit: project portfolio management aims to optimize the project portfolio towards a specific set of strategic goals. The emphasis here lies on portfolio optimization. Ok… but how?

Unfortunately, there is no go-to solution for optimizing one's project portfolio - or portfolios. In fact, several approaches are equally common and may be combined. Let’s take a rough look at these very portfolio optimization approaches before we dive deeper into each one.

Cost-Value Optimization: This commonly employed method relies on the so-called efficient frontier analysis. The primary constraint in cost-value optimization is the portfolio's budget allocation. In short, it is all about bang for the buck.

Resource Optimization: Another effective strategy involves capacity management analysis to optimize resource allocation. Resource availability serves as the primary constraint. In short, it is about getting as much work done with the number and quality of resources available.

Schedule Optimization: This method involves project sequencing, considering interdependencies. Schedule optimization's primary constraints include project timing and dependencies. In short, it is all about creating the most efficient and logical roadmap.

Portfolio balancing: Another, arguably less often executed form of optimization involves balancing risk, return, investment budgets, and a category set. The investment budget per category element acts as the major constraint. Whilst the category set may vary widely from company to company, it frequently contains the strategic goals and/or organizational units (such as legal entities, countries and so on). In short, it is about not laying all eggs in one basket but instead hedging project investments via spreading the risk over numerous projects, goals, and the organization.

Is this all too theoretical for your taste? We got you covered.

Before we delve deeper, in its purest form, portfolio optimization involves the creation of an optimal portfolio within existing limitations and constraints. It underscores the scientific aspect of project portfolio management, relying heavily on data-driven approaches and advanced analysis techniques. Whilst going about things pretty academically, one does not need to. Depending on the maturity of your PMO, your project portfolio, your company, and your company culture, you may want to get a little less academic - while still drawing on the general concepts offered by the various approaches to project portfolio optimization. This article will offer some insights for approaching project portfolio optimization a bit more hands-on and less data-driven. But before we can take this exit of the project portfolio route, getting a deeper understanding of the approaches is worthwhile.

Cost-Value-Optimization or the Efficient Frontier

A fundamental principle of project portfolio management (PPM) is to increase organizational value through its projects. Achieving this involves traditional cost-value optimization, often referred to as identifying the 'efficient frontier'. The objective is to pinpoint the project combination or mix that yields the highest business value within a specified budget. This approach aims to work right at the so-called efficient frontier.

The Efficient Frontier

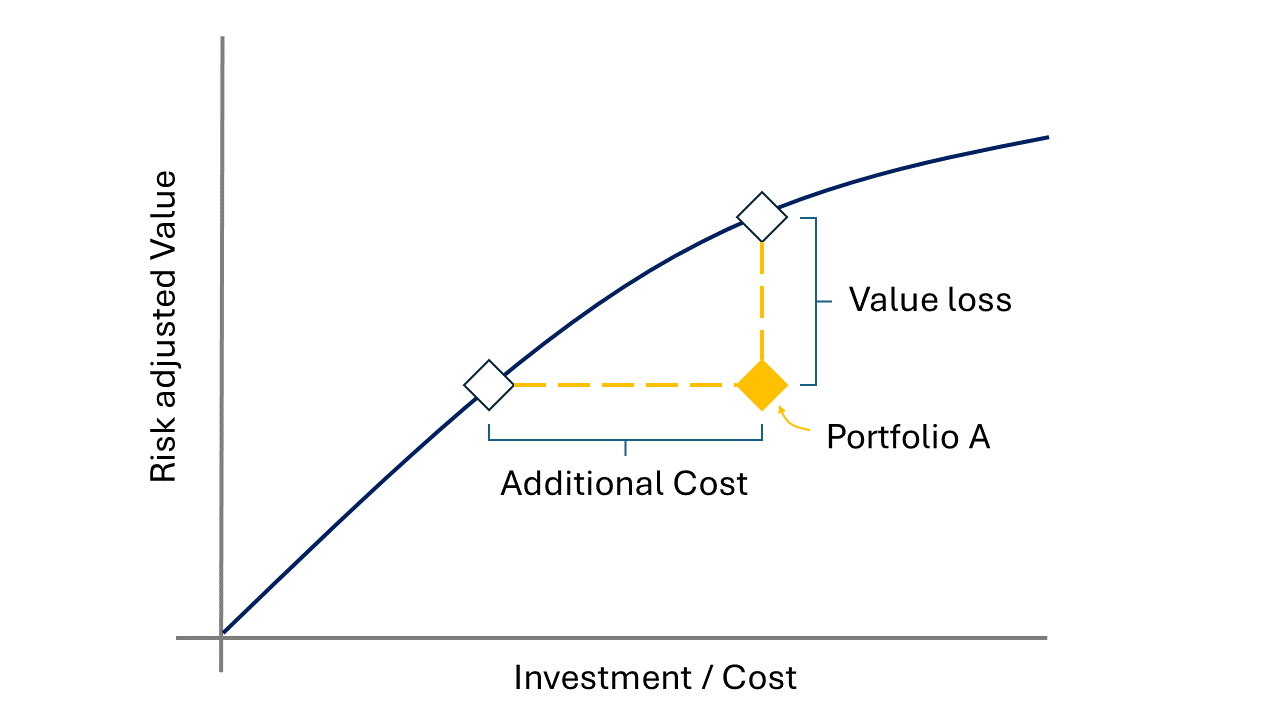

The efficient frontier is a portfolio of projects that are expected to yield the highest returns for a given level of risk. A portfolio achieves efficiency when no alternative portfolio can offer superior returns with an equivalent or lower level of investment. The positioning of portfolios along the efficient frontier is contingent upon the PMO’s tolerance for risk.

Have a look at the depiction below. It shows the efficient frontier as the line made up by plotting the maximum risk-adjusted portfolio value at a given portfolio cost. All portfolios - such as the example’s Portfolio A - ranging below the frontier are inefficient. They either accrue too much cost for a designated return or offer too little value at a given cost level.

Plotting the efficient frontier is not an easy task. It requires understanding the value impact of each project (e.g., the net present value - but more on project portfolio value later) and the associated cost. In addition, it requires ranking all possible project combinations at a given level of associated total cost to find the maximum risk-adjusted portfolio value. This sounds difficult to pull off - and it is.

But leaning on the concept of the efficient frontier as a means to optimize a project portfolio bears an important message and hence lesson: a prevalent method of ranking projects on impact and proceeding to select them from the top down until the budget is depleted may yield satisfactory outcomes. Still, it often falls short of achieving optimal results. Many organizations overlook identifying the optimal combination of projects to maximize business value. In reality, it's conceivable that two lower-priority projects combined could deliver greater business value than a single higher-priority project.

Resource Optimization

Resource optimization offers an alternative perspective to portfolio optimization by tackling practical resource constraints. It focuses on optimizing resource utilization and availability to create a feasible portfolio that can be realistically accomplished and delivered. One drawback of cost-value optimization is its failure to integrate resource availability and utilization into the analysis directly. While this approach may result in an optimal portfolio in terms of value, it could be unfeasible to deliver due to acknowledged resource constraints.

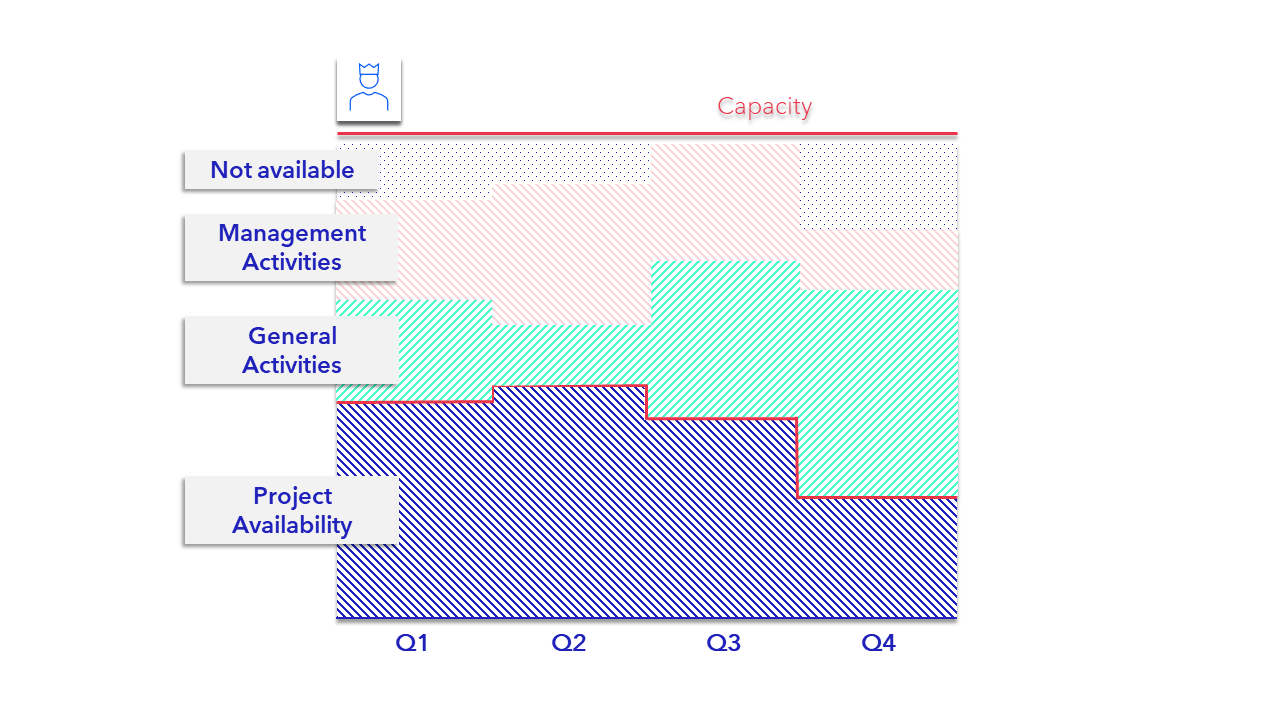

An initial strategy organizations can adopt is optimizing select key resources during annual planning. This entails estimating resource utilization for each role across various projects over the fiscal year. With a reasonable grasp of the actual capacity of each role, it becomes feasible to identify an optimal mix of projects that aligns with established resource constraints. On the very basic level, this method requires transparency regarding resource availability - and resource requirements for each project. If you happen to have that, this approach may yield good results.

However, there are several drawbacks. This method fails to consider the timing of resource requirements, potentially resulting in periods of unrealistic workloads due to project timing. It also assumes that resource estimates are reasonably accurate; however, when optimizing the portfolio at such a broad level, even slight adjustments to resource estimates could significantly alter the selection of projects within the optimization process. Especially when it becomes necessary to increase the level of detail - e.g., by looking at quarters or even months instead of the fiscal year - these problems gain potency. This aligns with the general difficulties of resource capacity planning and allocation discussed here. We are not trying to say you shouldn't use this method. However, it requires quite a bit of resource data availability and accuracy. If your portfolio happens to offer this, go for it! In fact, and especially if you are considering the following project portfolio optimization method, it is highly recommended to incorporate resource optimization, too.

Schedule Optimization

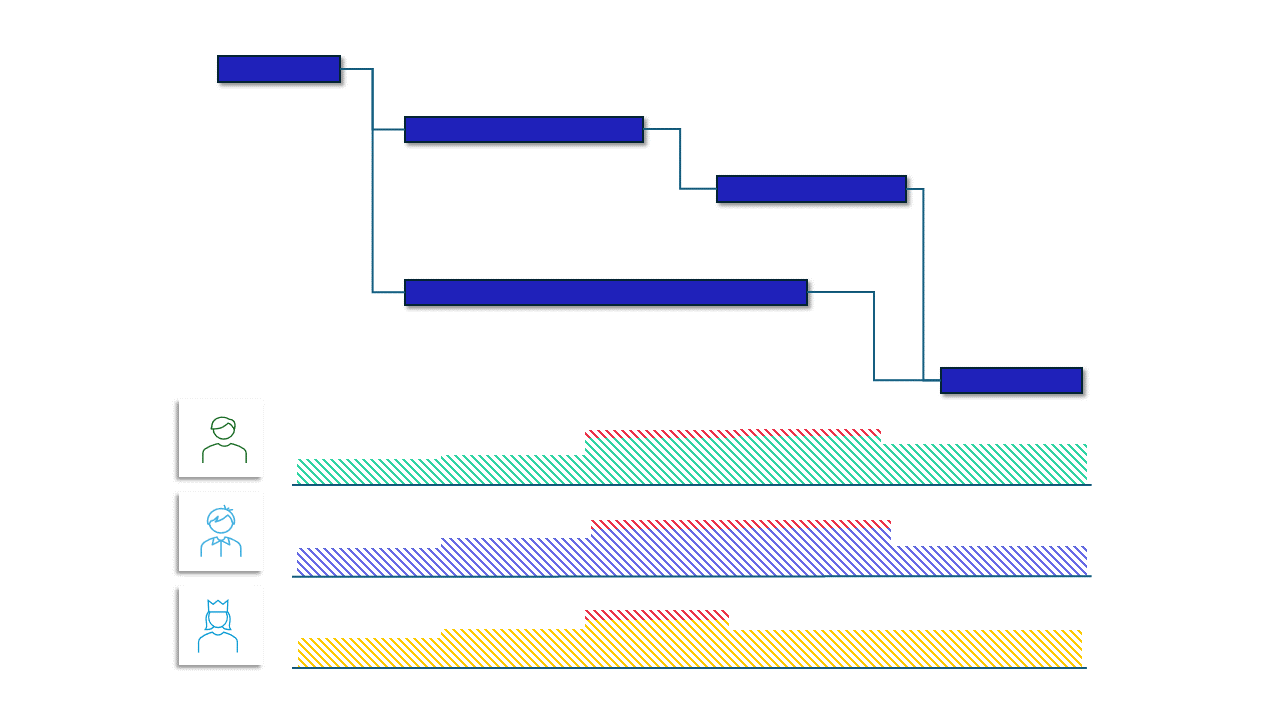

Another facet of project portfolio optimization involves schedule optimization within a multi-project environment, considering project interdependencies. The objective is to identify the critical path, representing the longest sequence projects and their tasks necessary to achieve the project portfolio's goals. This process entails delineating all tasks required for project completion, establishing their sequential order, and determining the longest duration for project completion, known as the 'critical path,' thereby providing a definitive timeline for project execution.

Tasks and projects are classified as either 'critical' or 'non-critical.' Critical tasks must ad here to their deadlines to ensure project completion as scheduled; any delay in these tasks will consequently delay the project. Non-critical tasks, however, offer some flexibility in scheduling and are less likely to impede project completion. The optimal portfolio is reached when creating maximum value in a given time frame under the constraints of logical dependencies. If you want to use this approach, you should consider project priorities and resource availability when sequencing projects.

This method draws on the so-called waterfall planning method. Like the resource optimization approach, it requires high certainty regarding project length and interdependencies. This is often not the case, especially when projects are in the early stages of their life cycle or if the portfolio environment is rather turbulent. However, more agile methodologies do not pair well with the schedule optimization approach. Nonetheless, we look into how to deal with changes later in this article.

Portfolio Balancing

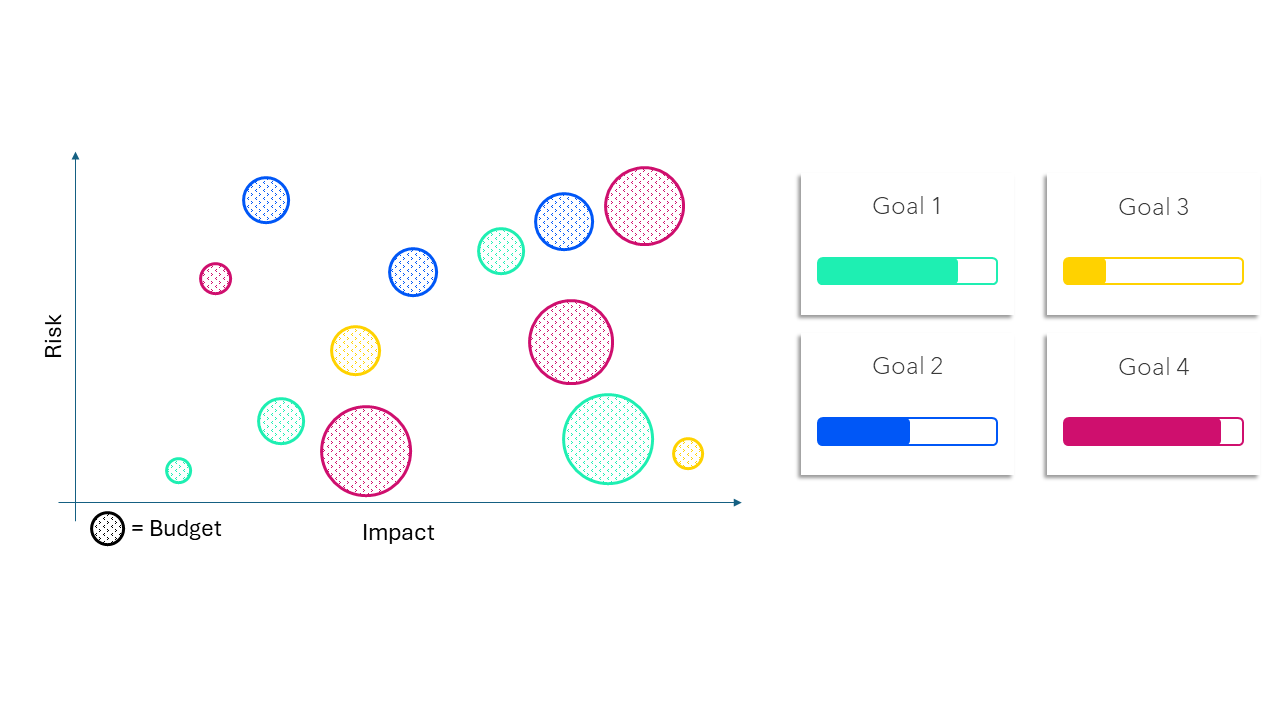

Another optimization approach that complements project selection is known as portfolio balancing. Essentially, this method assists in achieving a well-rounded investment. The concept of 'portfolio balance' often involves visualizing the portfolio through risk-value bubble charts. The entire idea is to refrain from overinvesting in low-value or high-risk areas. Balancing investments can also support a distributed investment strategy across various dimensions, such as business units, product lines, and strategic goals.

In short, the goal is to maximize impact under the constraint of risk and min./max. investment for categories defined upfront. This approach requires setting investment constraints for the designated categories as a first step. That is setting lower and upper investment boundaries. For example, management could invest at least 1 million into Business Unit A and not more than 1.5 million, whilst doubling down on Business Unit B. Similarly, investment constraints are assigned to strategic goals or other relevant categories.

Given these constraints, a portfolio is optimized when reaching maximum total impact whilst keeping within the constraints set up front. Unsurprisingly, project portfolio balancing is commonly utilized alongside cost-value optimization.

What is the portfolio value?

We have left quite an essential thing for granted thus far. Project portfolio value. After all, project portfolio optimization is all about maximizing value, right? But how is this value defined? This is a difficult one. Conventional portfolio theory assumes that project and portfolio value solely revolves around financial metrics. However, project value should encompass qualitative or intangible benefits that extend beyond metrics like net present value (NPV) or return on investment (ROI). The portfolio's value should also align with strategic objectives and the fulfillment of organizational goals.

In our earlier discussion on project prioritization and aligning the project portfolio with the strategic goals, we emphasized the necessity for the PMO and C-Level to define 'value,' recognizing its variability across companies. Once this definition is established, a scoring model can be devised to assess project value. These prioritization scores reflect the relative value of projects and can subsequently inform portfolio optimization efforts. Senior leaders may limit portfolio optimization to financial considerations alone without a clear definition of value, which may not yield optimal strategic outcomes. By incorporating strategic alignment and other business drivers, a more comprehensive evaluation of project value can be achieved, thereby optimizing the project portfolio.

The hands-on approach to project portfolio optimization and management

All approaches discussed in this article require a lot of data - whether on risk-adjusted value, resources, or tasks and timing. Projects that are early in their lifecycle tend to offer little certainty regarding this data. Yet employing sophisticated optimization algorithms yields dodgy results if the input is of low quality and certainty. Suppose you work in a Project Management Office and feel uncomfortable presenting your management with a project portfolio optimized on shaky data. In that case, there is a way forward without spending hours verifying assumptions and data points: drawing on your team and utilizing a bottom-up approach. This method banks on bringing your stakeholders together in a workshop setting to gauge the optimal portfolio in a stringent process. This is how it works:

- Parameters: Decide what parameters you want to use to optimize your portfolio (e.g. impact, risk, budget size, needed resources).

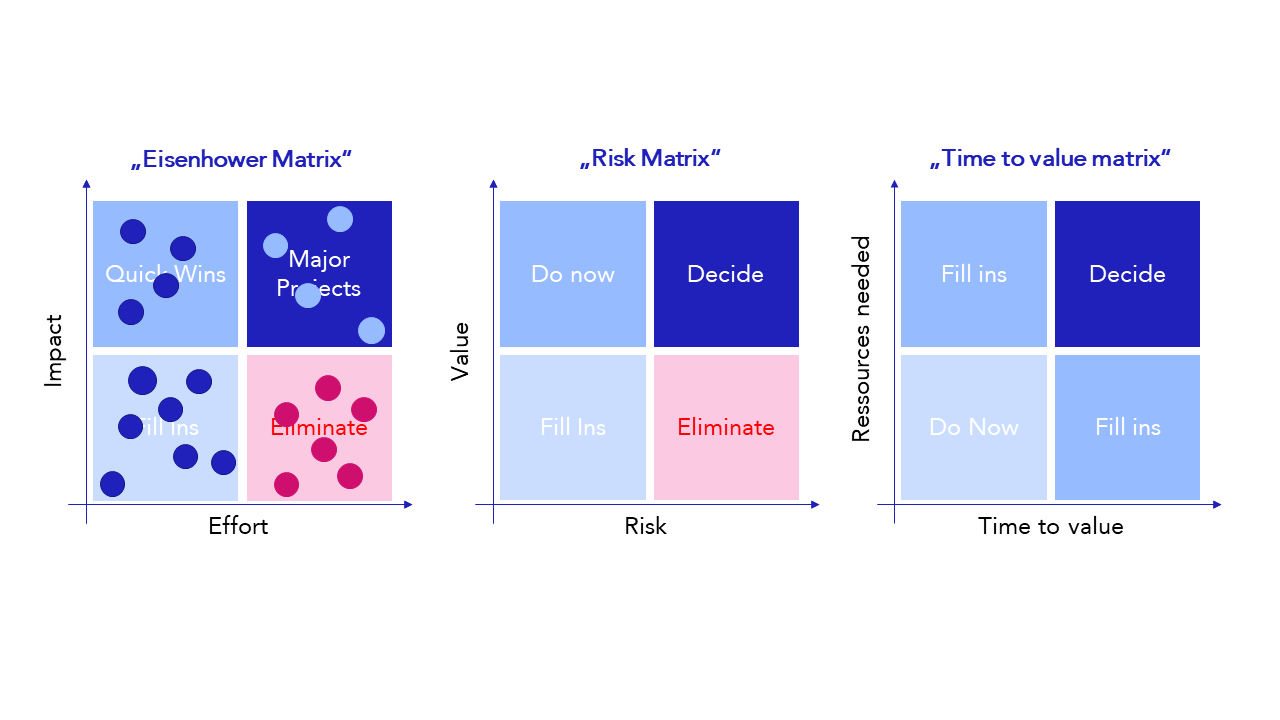

- Matrices: Draw a couple of matrices, such as those in the picture below. Use your parameters from step one as axis labels.

- Projects: Have all projects ready. If you do this with everybody in the room, we recommend post-its.

- Stakeholders: Get your project managers together. You may want to involve other stakeholders, too. Many organizations bring in upper management, IT, and controlling.

- Placement: Position your projects in the matrices as a group task. The actual position is of little importance. Focus on the relative position of projects towards each other.

- Discussion: Ensure that you keep a discussion going in the team while placing the projects. A good way to foster a discussion is to have the project managers place their projects independently and one by one. Have them explain why they chose the very spot in the matrix while doing so.

- Critical Path: Have the project managers discuss interdependencies. If you go old-school with this, connect interdependent projects with some yarn.

- Voting: In the last step, let the team vote on what projects they would include in the portfolio. You can use little stickers to do so. Make sure to set the maximum number of votes so little that it will be hard to choose.

This exercise may seem tedious. However, it has tremendous benefits. For one, you foster an understanding of building a project portfolio - rather than managing individual projects - amongst your stakeholders. In addition, you will get a feel for the relative position of projects in relation to impact, risk, needed resources and budget, dependencies, and so on. This will help get a feel for what projects should be part of your portfolio, their priority, key risks, and, most importantly, what projects should not be part of your portfolio.

Naturally, this approach will not yield an optimized project portfolio in a mathematical sense. But it has the great potential to get a shared understanding amongst your organization’s stakeholders and hence a solid portfolio to get things going.

Management: How do deal with change and the role of stage gates

Given that new project ideas may arise and things generally tend to change over time, you should combine this approach with a steering committee, a strict reporting cycle, and stage gates.

You need to report on your project portfolio progress to the management. A wonderful place to have that very reporting presented is a steering committee. It should consist of the CEO, the PMO, and all relevant project managers/sponsors - and oftentimes the CFO. Have the committee come together regularly. Monthly often does the trick - although you may want to start biweekly. The PMO should prepare the meeting and have a project portfolio report. It should give you a sense of the overall portfolio health and be the basis for making portfolio decisions.

Make sure to use stage gates as part of your reporting. Stage gates deserve their own article. But here is the gist: In project portfolio management, a stage gate is a strategic milestone or decision point separating different phases of a project. Project progress is evaluated at each gate, and key decisions are made regarding whether to proceed, modify, or halt the project. Think of stage gates as checkpoints in the project journey, allowing organizations to maintain control, allocate resources wisely, and align projects with overall business strategy. The goal is always to know in which phase a project resides - respectively, what needs to be done to move over to the next phase. With this approach, you can create a system that easily compares projects in your portfolio. In addition, it allows for making informed portfolio decisions.

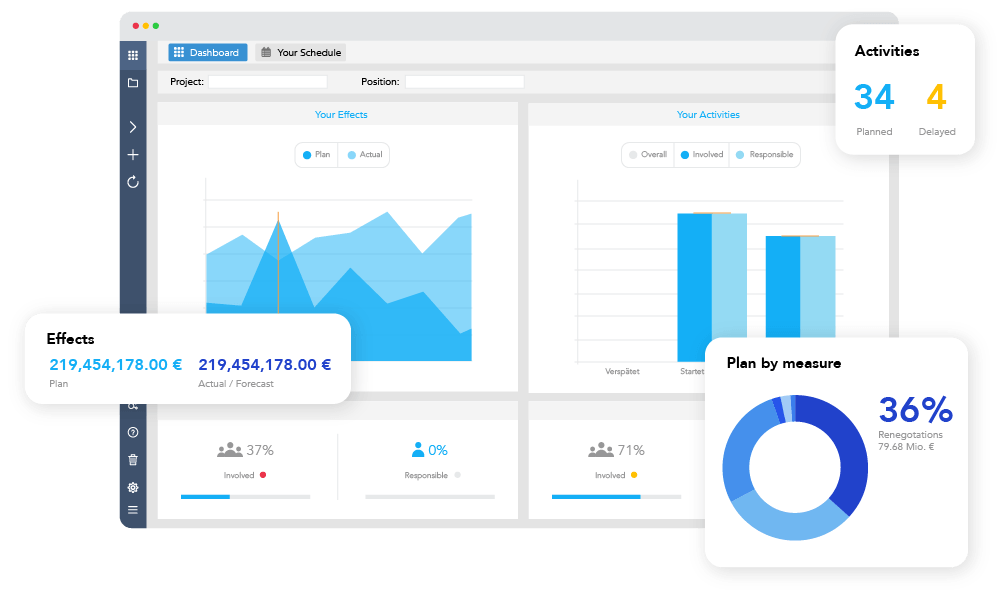

This is quite a task. Try to keep the administrative hustle as little as possible. Please do not rely on spreadsheets to make this happen. Depending on the size of your project portfolio, you will enter a world of trouble. We are not saying you need to use Falcon - but think about using a suitable Project Portfolio Management Software Solution. If you wonder what a suitable PPM solution needs to offer, this article may help.

Do you want to align your strategic goals with your project portfolio? Get to know our software Falcon!

Falcon may be the ideal lightweight PPM software solution for you. We would be delighted to schedule a personal meeting to demonstrate how Falcon and its many features can support you in your individual case and save your team a lot of time in their PPM work.

Learn more

Summary

Project portfolio management (PPM) involves optimizing project portfolios to achieve strategic goals. Common approaches include cost-value optimization, resource optimization, schedule optimization, and portfolio balancing.

Cost-value optimization maximizes business value within budget constraints, while resource optimization focuses on efficient resource utilization. Schedule optimization streamlines project timelines by identifying critical paths, and portfolio balancing distributes investments to mitigate risks. The approaches require accurate and reliable project data. Oftentimes, this data is not available. A collaborative approach involving stakeholders facilitates decision-making and prioritization.

Continuous monitoring is essential to keep a handle on the portfolio. Integrating stage gates and a steering committee ensures informed decision-making throughout the project lifecycle. Software helps with these tasks. Spreadsheets do not.

Organizations can optimize project portfolios by implementing these strategies to maximize value and align with business objectives.